Chapter 15 – Depreciation – TS Grewal 2022

Written Down Value Method

Question 24

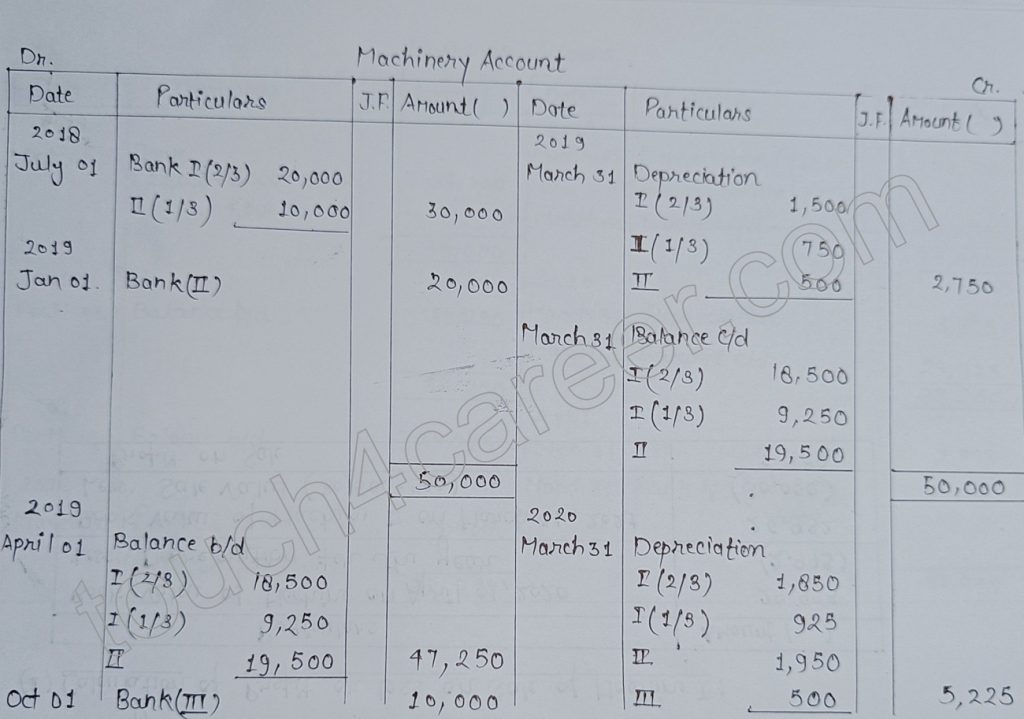

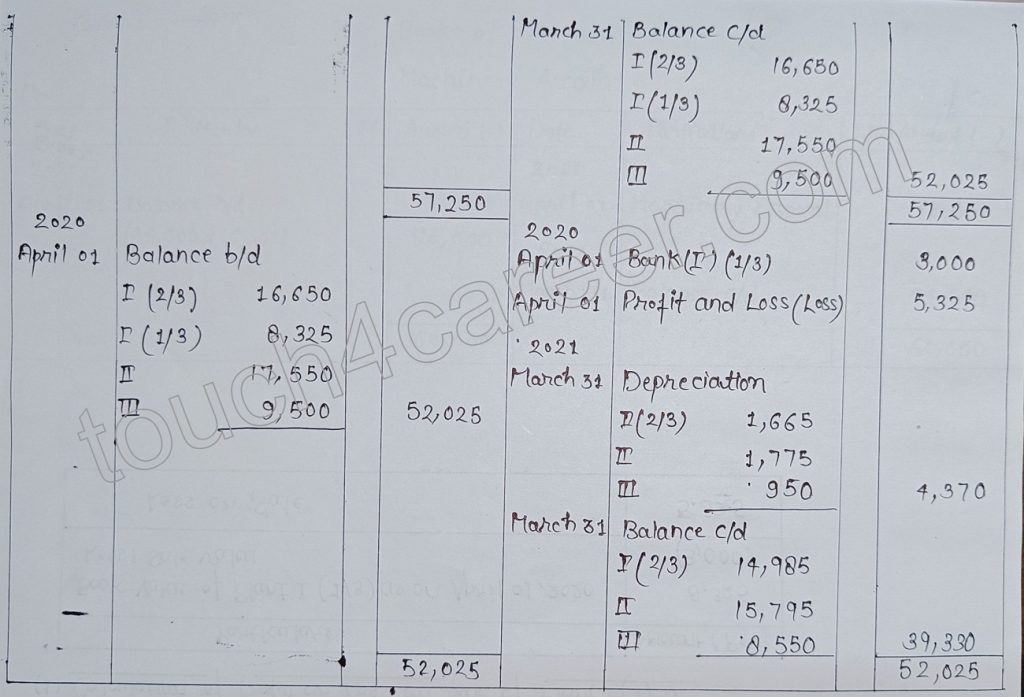

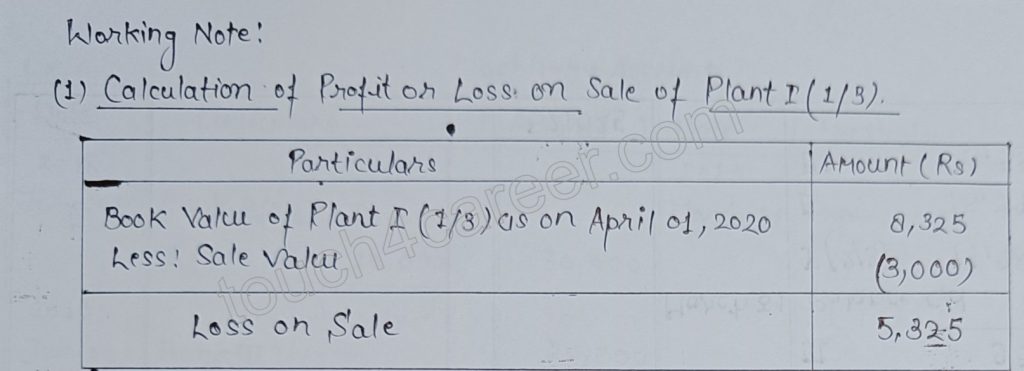

A company purchased on 1st July, 2018 machinery costing 30,000. It further purchased machinery on 1st January, 2019 costing 20,000 and on 1st October, 2019 costing 10,000. On 1st April, 2020, one-third of the machinery installed on 1st July, 2018 became obsolete and was sold for 3,000. The company follows financial year as accounting year.

Show how the Machinery Account would appear in the books of company if depreciation is charged @ 10% p.a. on Written Down Value Method.

Solution

A company purchased on 1st July 2018