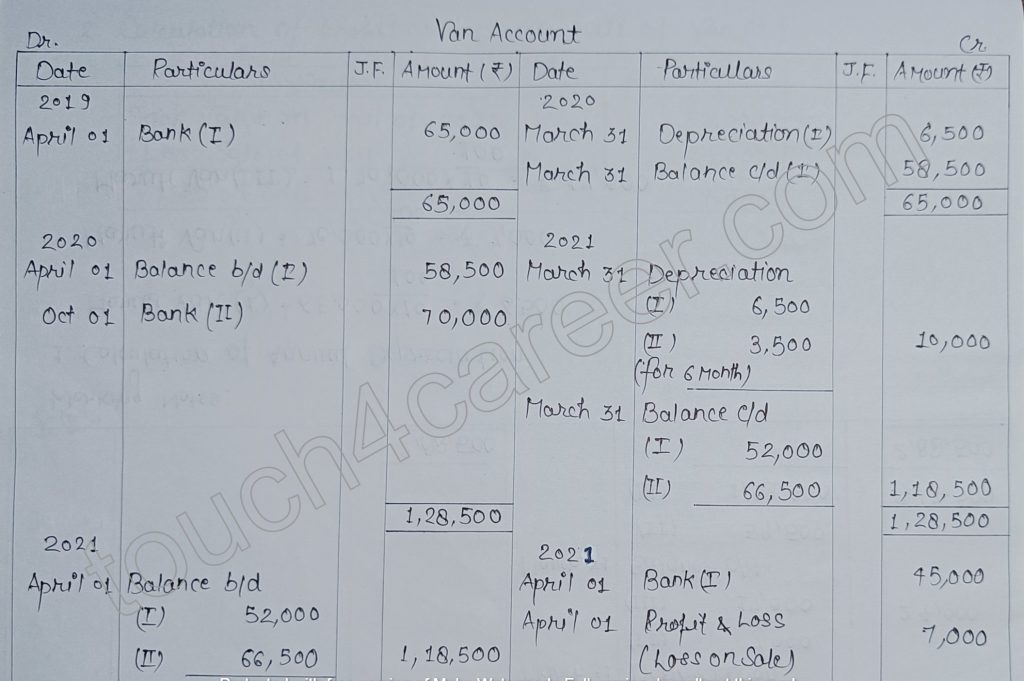

Chapter 15 – Depreciation – TS Grewal 2022

Straight Line Method (SLM)

Question 10

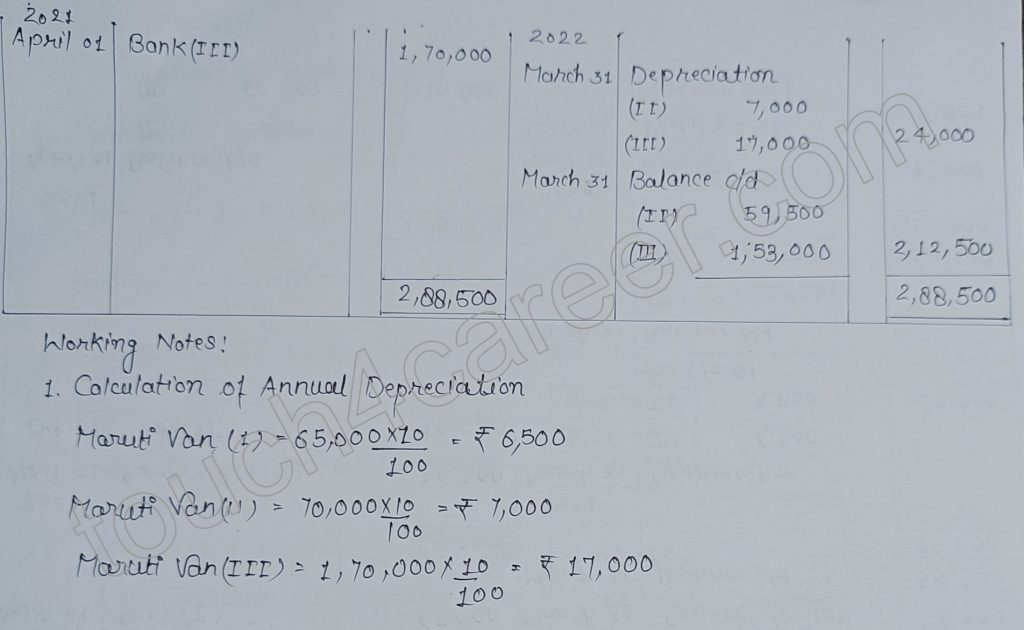

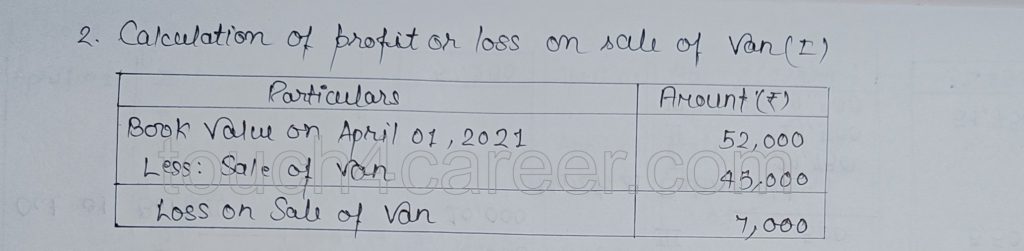

A Van was purchased on 1st April 2019 for 60,000 and 5,000 was spent on its repair and registration. On 1st October, 2020 another van was purchased for 70,000. On 1st April, 2021, the first van purchased on 1st April, 2019 was sold for 45,000 and a new van costing 1,70,000 was purchased on the same date. Show the Van Account from 2019-20 to 2021-22 on the basis of Straight Line Method, if the rate of Depreciation charged is 10% p.a. Assume that books are closed on 31st March every year.

Solution

A Van was purchased on 1st April