Chapter 4-Change in Profit Sharing Ratio among the Existing Partners -TS Grewal’s 2021

Asha Nisha and Disha chapter-4 TS Grewal Question 5, 6, 7, 8

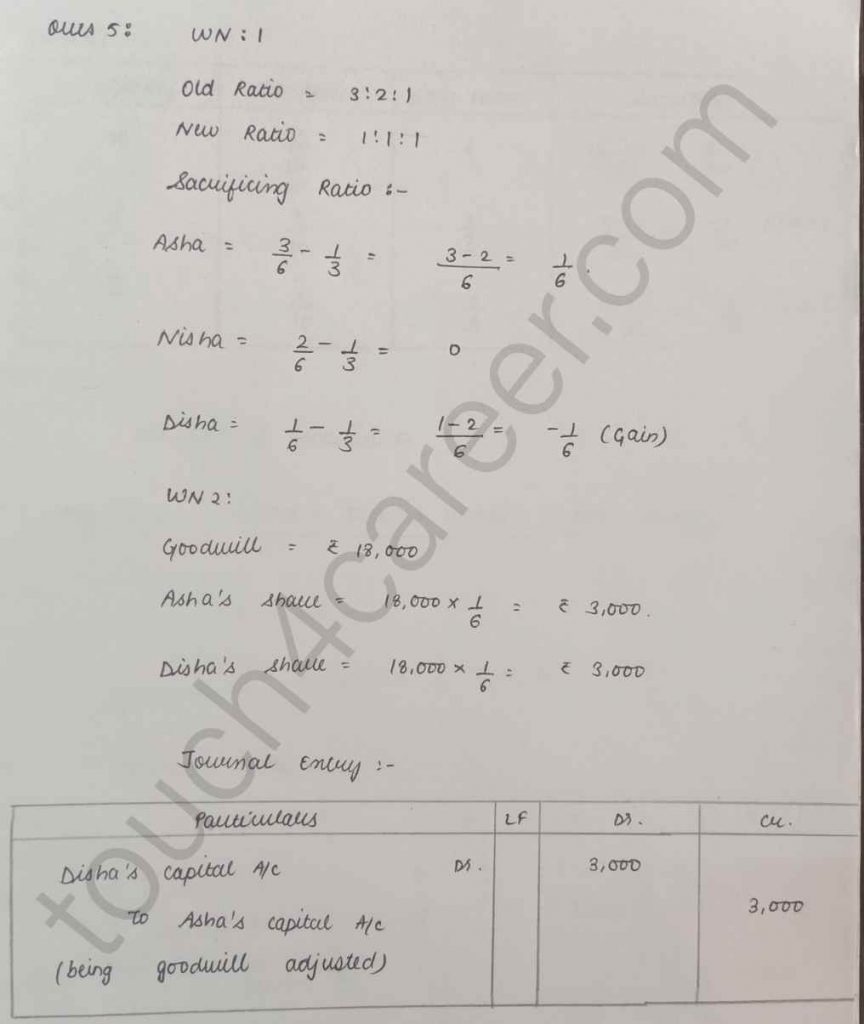

Q:- 5

Asha, Nisha and Disha shared profits and losses in he ratio of 3:2:1 respectively. The effect from 1st April 2021, They agreed to share profits equally. The goodwill of the firm was valued at ₹18,000. Pass necessary Journal entries to record the above change.

Solution:

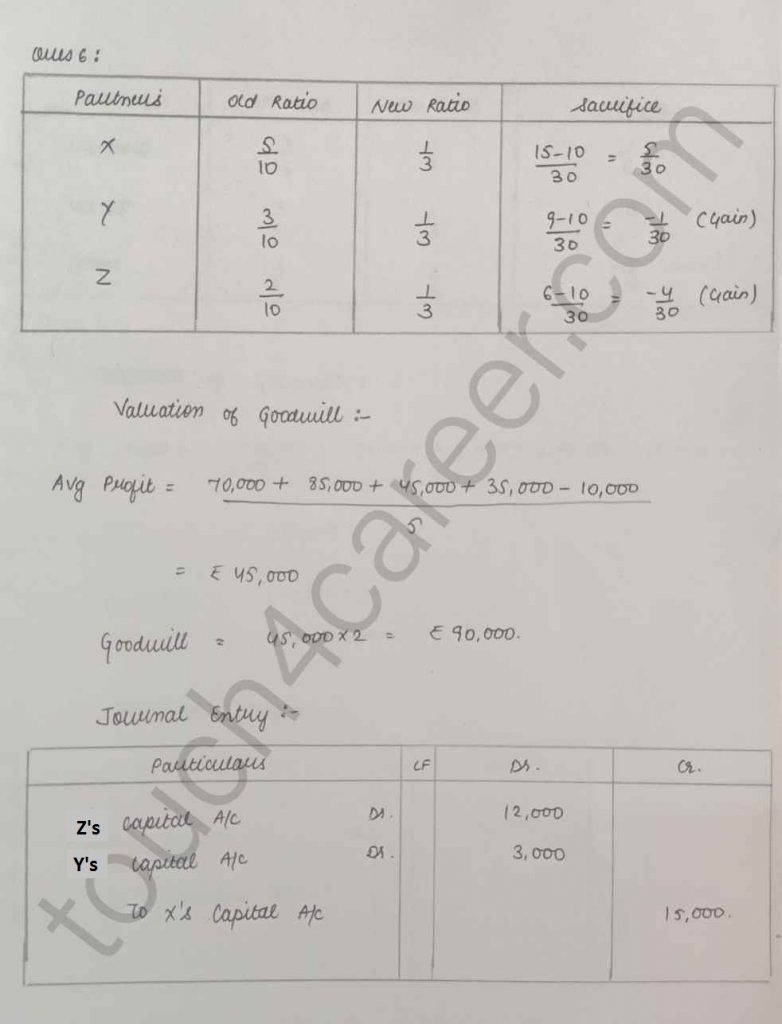

Q:- 6

X ,Y and Z are partners sharing profit and loses in the ratio of 5:3:2. From the 1st April,2021. They agreed to the share profits equally. The partnership deed provides that in the event of any change in the profit sharing ratio. The goodwill is to be valued at two year’s purchase of the average profit of the preceding five years. The profits and losses of the preceding years ended 31st march, are:

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Profits (in ₹) | 70,000 | 75,000 | 55,000 | 35,000 | 10,000 (Loss) |

You are required to calculate goodwill and pass journal entry.

Solution:

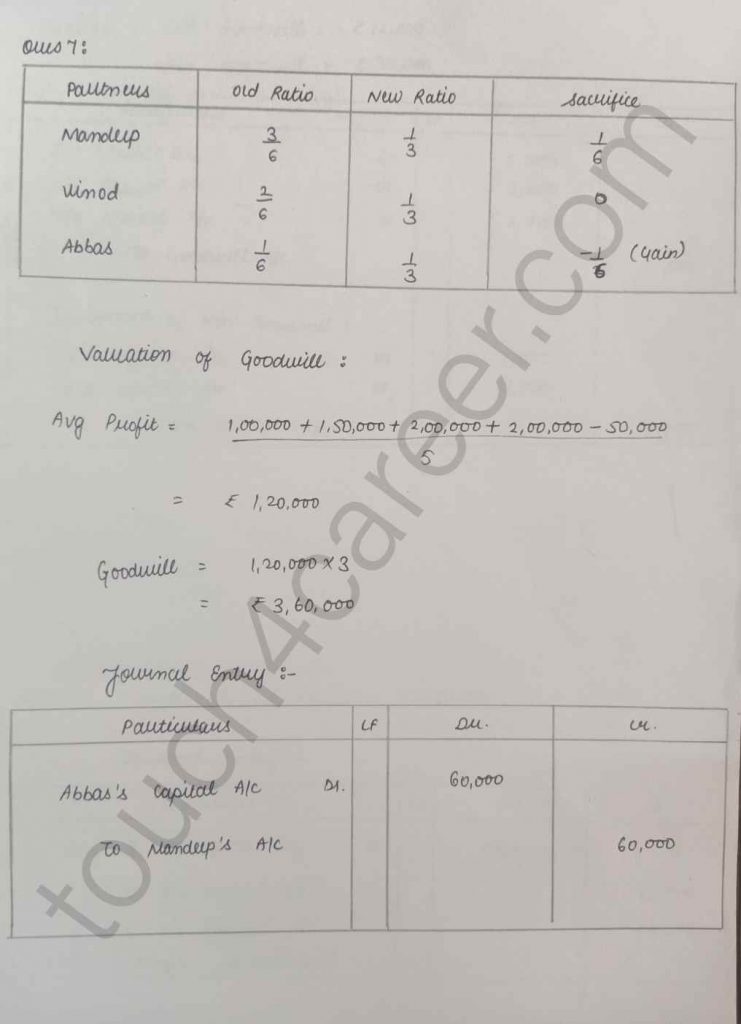

Q:- 7

Mandeep, Vinod and Abbas are partners sharing profits and losses in the ratio of 3 : 2 : 1. From the 1st April 2021. They decided to share profits and losses equally. The Partnership Deed provides that in the event of any change in the profit-sharing ratio. The goodwill shall be valued at three years purchase. The average profit of last five years. The profits and losses of the past five years are:

Profit – Year ended 31st March, 2017 – ₹1,00,000; 2018 – ₹1,50,000; 2020 – ₹2,00,000; 2021 – ₹2,00,000; Loss – Year ended 31st March, 2019 – ₹50,000.

Pass the journal entries showing the working.

Solution:

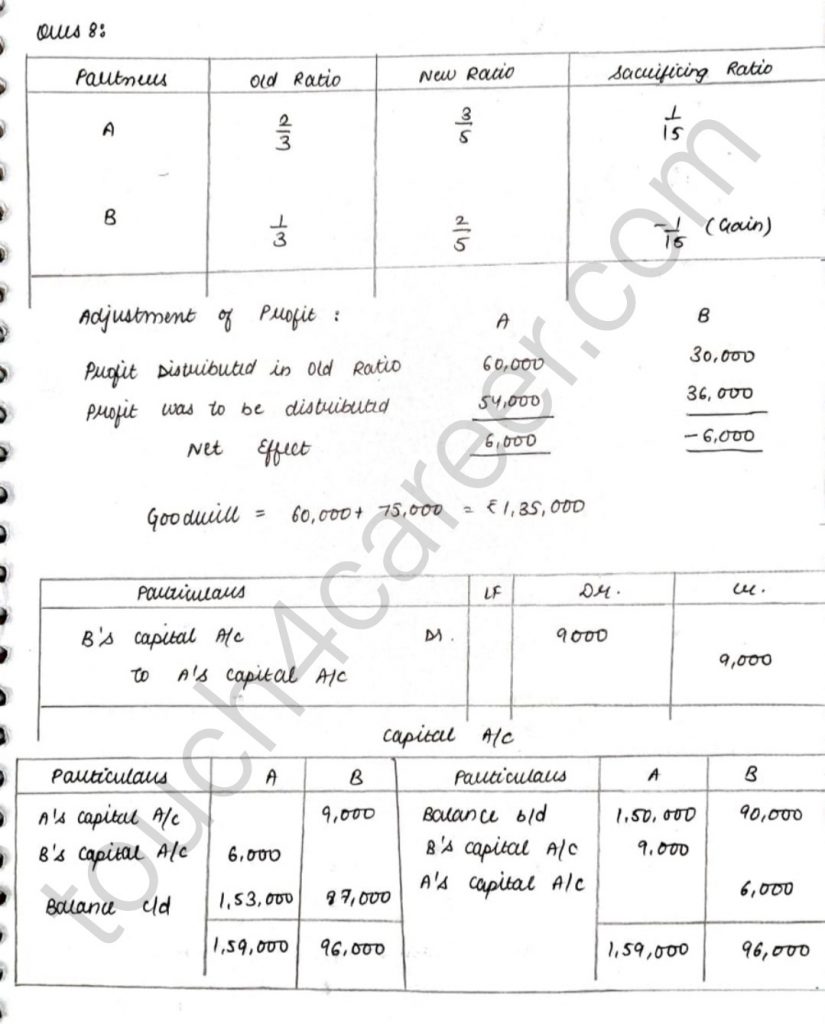

Q:- 8

A and B are partners in a firm sharing profits in the ratio of 2:1. They decided that effect from 1st April 2020. They would share profits in the ratio 3:2. But, This decision was taken after the profit for the year ended 31st March 2021. Of the ₹90,000 was distributed in the old ratio.

Firm’s goodwill was valued on the basis of aggregate of two year’s profits preceding the date decision became effective.

Profits for the years ended 31st march,2019 and 2020 were ₹60,000 and ₹75,000 respectively.It was decided that goodwill account will not be opened in the books of the firm and necessary adjustment be made through capital account which on 31st march,2021 stood at ₹1,50,000 for A and ₹90,000 for B.

Pass necessary Journal entries and prepare partners capital accounts.

Solution:

Jump to other solution of Profit Sharing Ratio:

Sacrificing and Gaining Share – Question number 1-4

Accounting of Goodwill – Question number 5-8

Accounting of Reserves,Accumulated Profits and Losses – Question number 9-19

Revaluation of Assets and Reassessment of liabilities – Question number 20-23

Preparation of Balance Sheet – Question number 24-25

Adjustment of Capital – Question number 26-27