Chapter 3 Goodwill:Nature and Valuation-TS Grewal’s 2021

TS Grewal Question 23, 24, 25

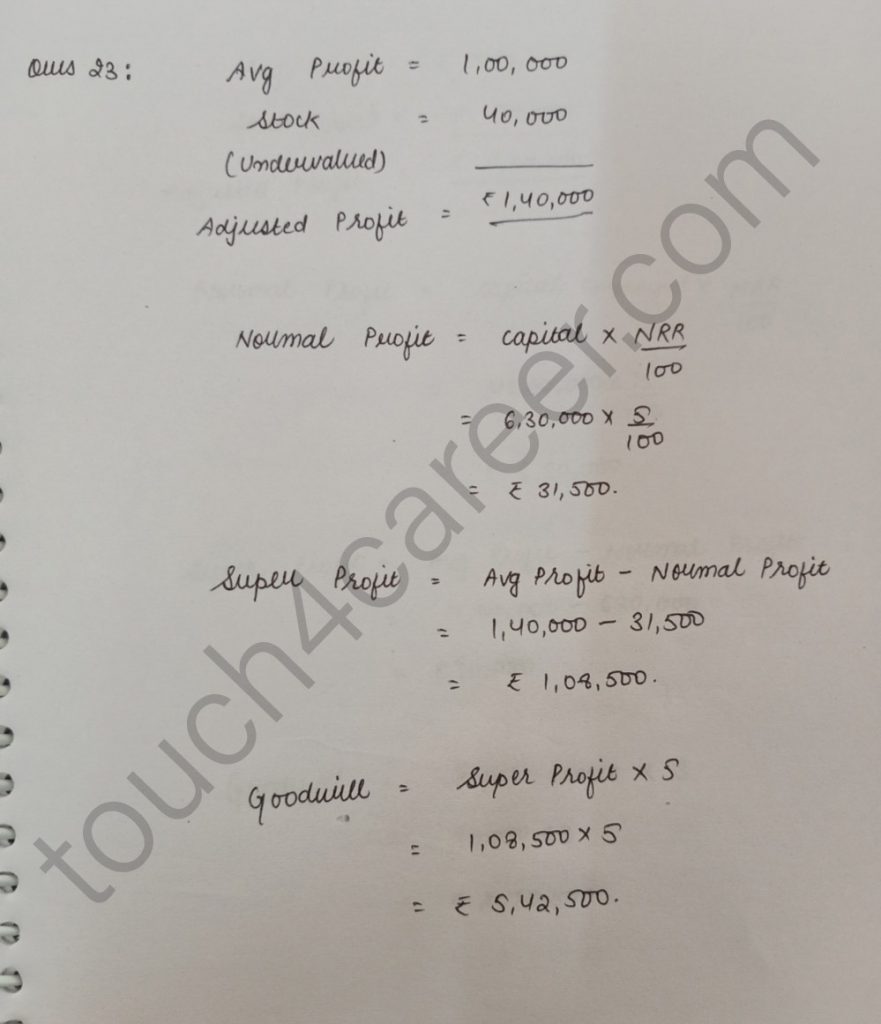

Question 23

Average profit earned by a firm is Rs.1,00,000 which includes undervaluation of stock of Rs.40,000 on an average basis. the capital invested in the business is Rs.6,30,000 and the normal rate of return is 5%. Calculate goodwill of the firm on the basis of 5 times the super profit.

Solution:

Click here for video explanation:- https://youtu.be/h3gMncZOAF4

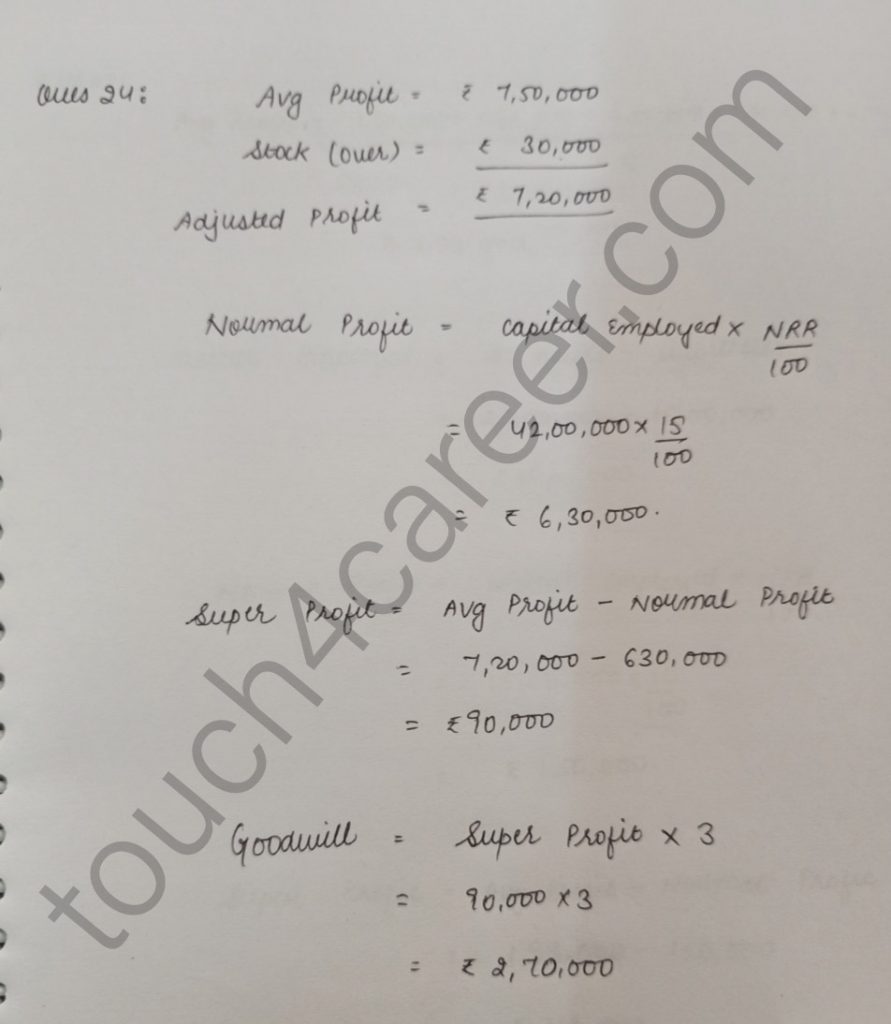

Question 24

Average profit earned by a firm is Rs.7,50,000 which includes overvaluation of stock of Rs.30,000 on an average basis. The capital invested in the business is Rs.42,00,000 and the normal rate of return is 15%. Calculate goodwill of the firm on the basis of 3 times the super profit.

Solution:

Click here for video explanation:- https://youtu.be/h3gMncZOAF4

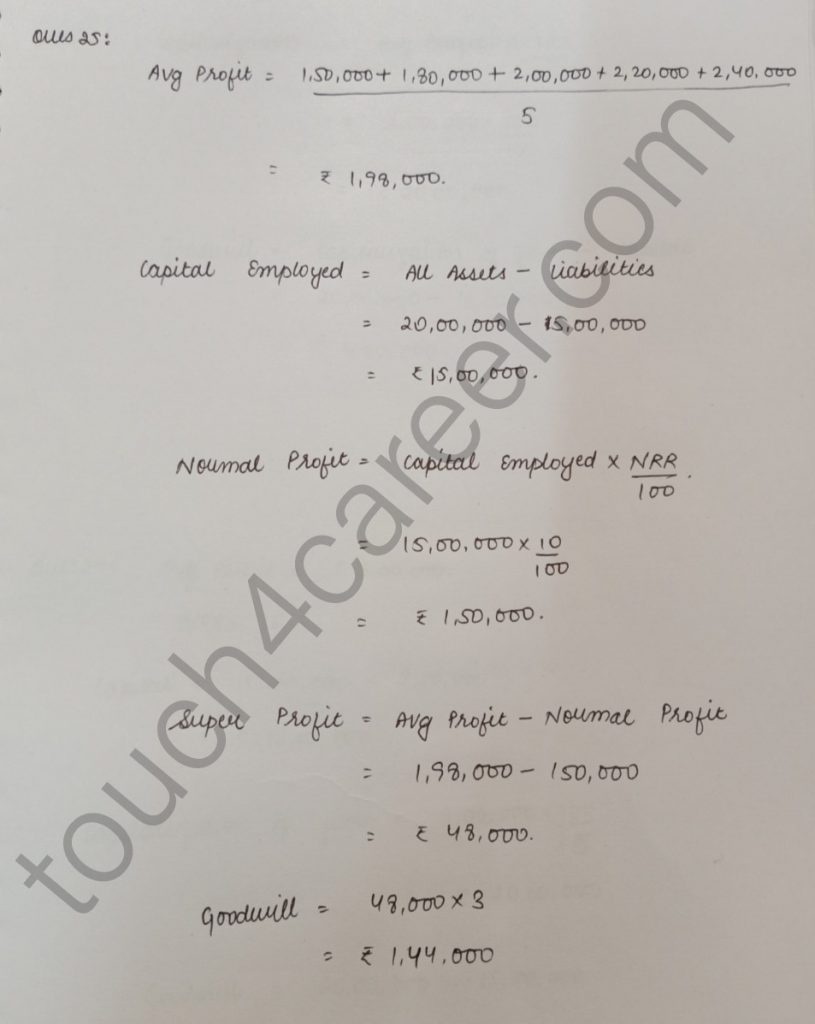

Question 25

Ayub and Amit are partners in a firm and they admit Jaspal into partnership w.e.f. 1st April, 2021. They agreed to value goodwill at 3 years purchase of super profit method for which they decided to average profit of last 5 years. The profits for the last 5 years were:

Year ended——————– Net Profits (Rs.)

31st March, 2017 ————- 1,50,000

31st March, 2018 ————- 1,80,000

31st March, 2019 ————- 1,00,000 (including abnormal loss of 100000)

31st March, 2020 ————- 2,60,000 (including abnormal gain (profit) of 40000)

31st March, 2021 ————- 2,40,000

The firm has total assets of ₹20,00,000 and Outside Liabilities of ₹5,00,000 as on that date. Normal Rate of Return in similar business is 10%. Calculate value of goodwill.

Solution:

Ayub and Amit are partners in a firm

Click here for video explanation:- https://youtu.be/h3gMncZOAF4

Jump to other solutions of Goodwill:

Average Profit Method – Question number 1-6

Average Profit Method when Past Adjustments are Made – Question number 7-12

Weighted Average Profit Method – Question number 13-14

Super Profit method – Question number 15-22

Super Profit Method when Past Adjustments are Made – Question number 23-25

Capitalisation Method – Question number 26-33

Capitalisation of Super Profit – Question number 34-39