Chapter 3 Goodwill:Nature and Valuation-TS Grewal’s 2021

TS Grewal Question 26, 27, 28, 29, 30, 31, 32, 33

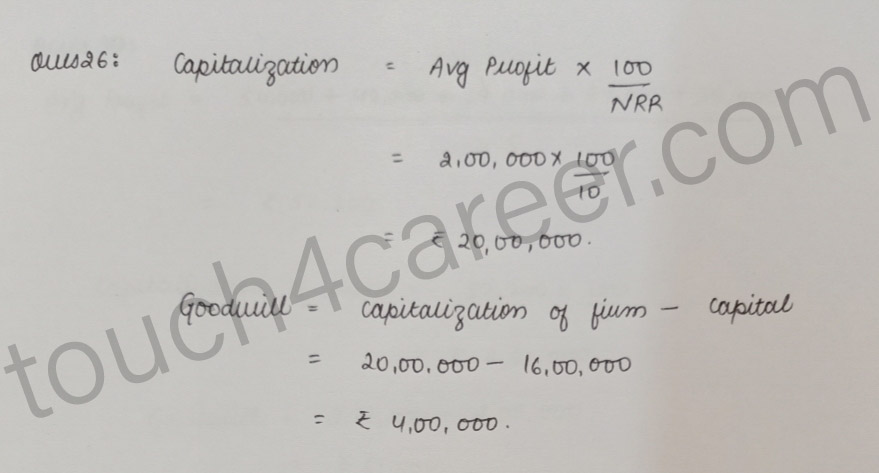

Question 26

From the following information, calculate value of goodwill of the firm by applying capitalisation method:

Total Capital of the firm Rs.10,00,000

Normal rate of return 10%

Profit for the year Rs.2,00,000.

Solution:

Click here for video explanation:- https://youtu.be/UaXpxlyzc5c

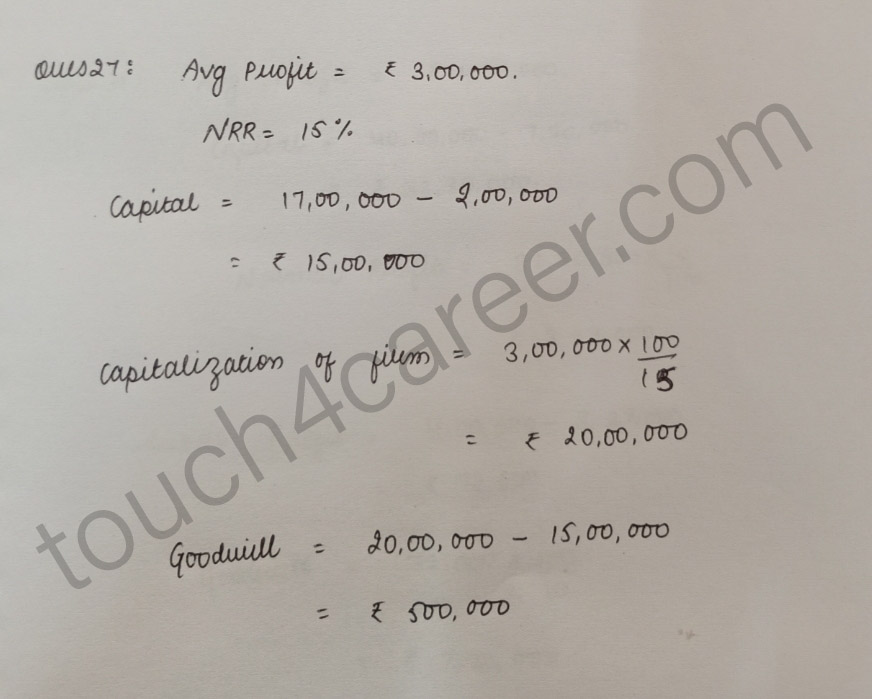

Question 27

A firm earned average profit of Rs.3,00,000 during the last few years. The normal rate of return of the industry is 15%. The assets of the business were Rs.17,00,000 and its liabilities were Rs.2,00,000.

Calculate the goodwill of the firm by capitalisation of average profit method.

Solution:

Click here for video explanation:- https://youtu.be/UaXpxlyzc5c

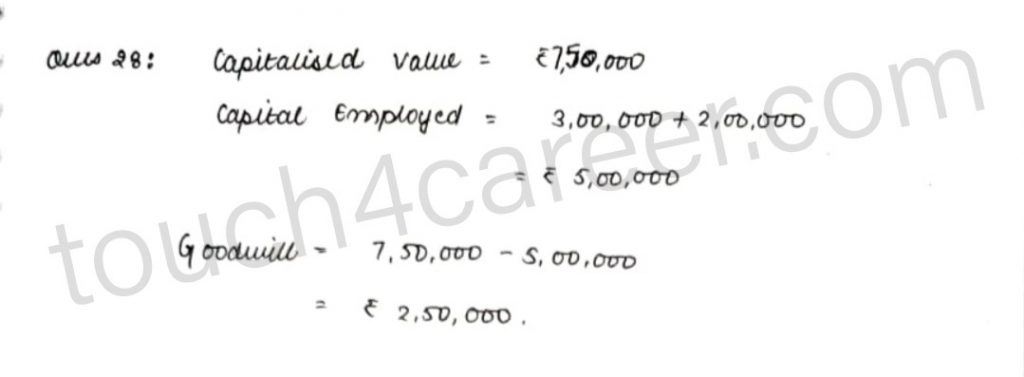

Question 28

A and B were partners in a firm with capitals of Rs.3,00,000 and Rs.2,00,000 respectively. the normal rate of return was 20% and the capitalised value of average profits was Rs.7,50,000. Calculate goodwill of the firm by capitalisation of average profits method.

Solution:

Click here for video explanation:- https://youtu.be/UaXpxlyzc5c

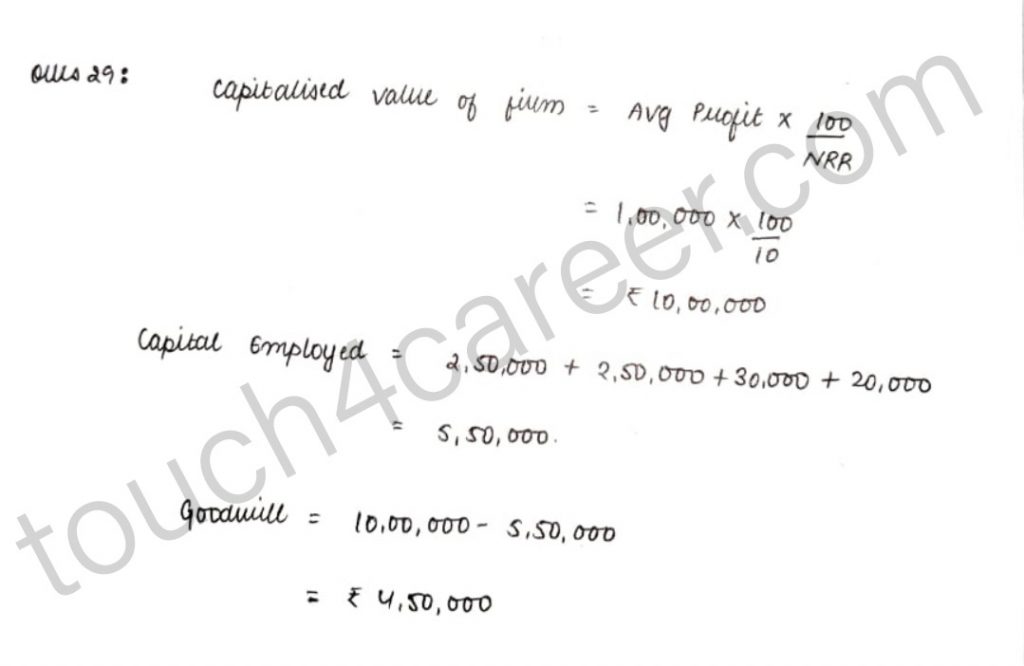

Question 29

Puneet and Tarun are in restaurant business having credit balances in their fixed capital accounts as Rs.2,50,000 each. They have credit balances in their current accounts of Rs.30,000 and Rs.20,000 respectively. The firm does not have any liability. they are regularly earning profits and their average profit of last 5 years is Rs.1,00,000. If the normal rate of return is 10%, find the value of goodwill by Capitalisation of Average Profit Method.

Solution:

Puneet and Tarun are in restaurant business

Click here for video explanation:- https://youtu.be/UaXpxlyzc5c

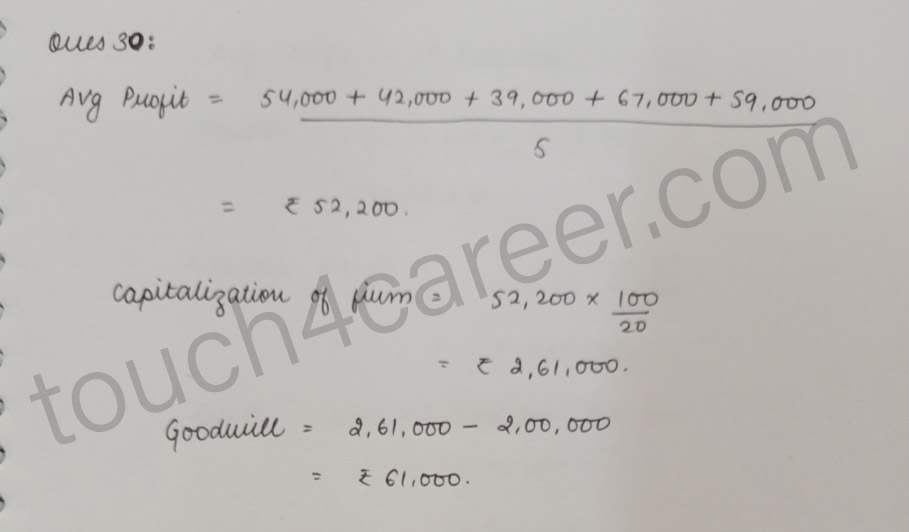

Question 30

From the following particulars, calculate value of goodwill of a firm by capitalisation of average profit Method:

i. Profit of last five consecutive years ending 31st March, are:

2021 – Rs.54,000; 2020 – Rs.42,000; 2019 – Rs.39,000; 2018 – Rs.67,000 and 2017 – Rs.59,000

ii. Capitalisation rate 20%.

iii. Net assets of the firm Rs.2,00,000

Solution:

Click here for video explanation:- https://youtu.be/UaXpxlyzc5c

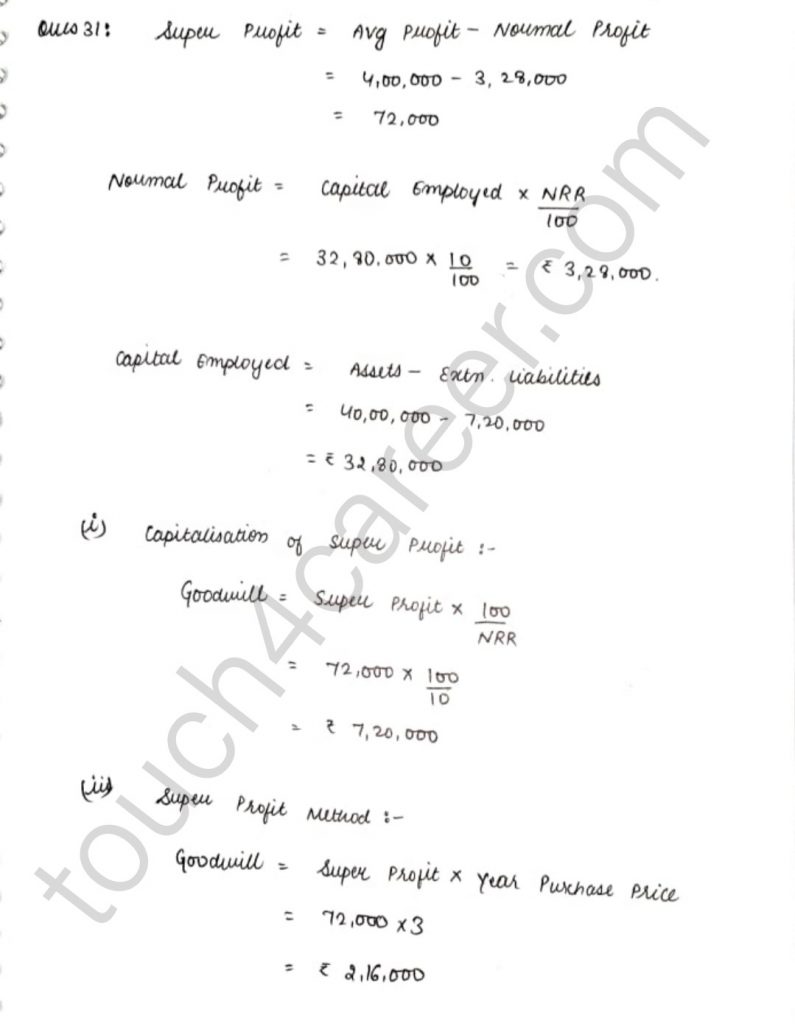

Question 31

A business has earned average profit of Rs.4,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

i. Capitalisation of Super Profit Method, and

ii. Super profit method if the goodwill is valued at 3 years purchase of super profits.

Assets of the business were Rs.40,00,000 and its external liabilities Rs.7,20,000.

Solution:

Click here for video explanation:- https://youtu.be/cVqRLM39QhQ

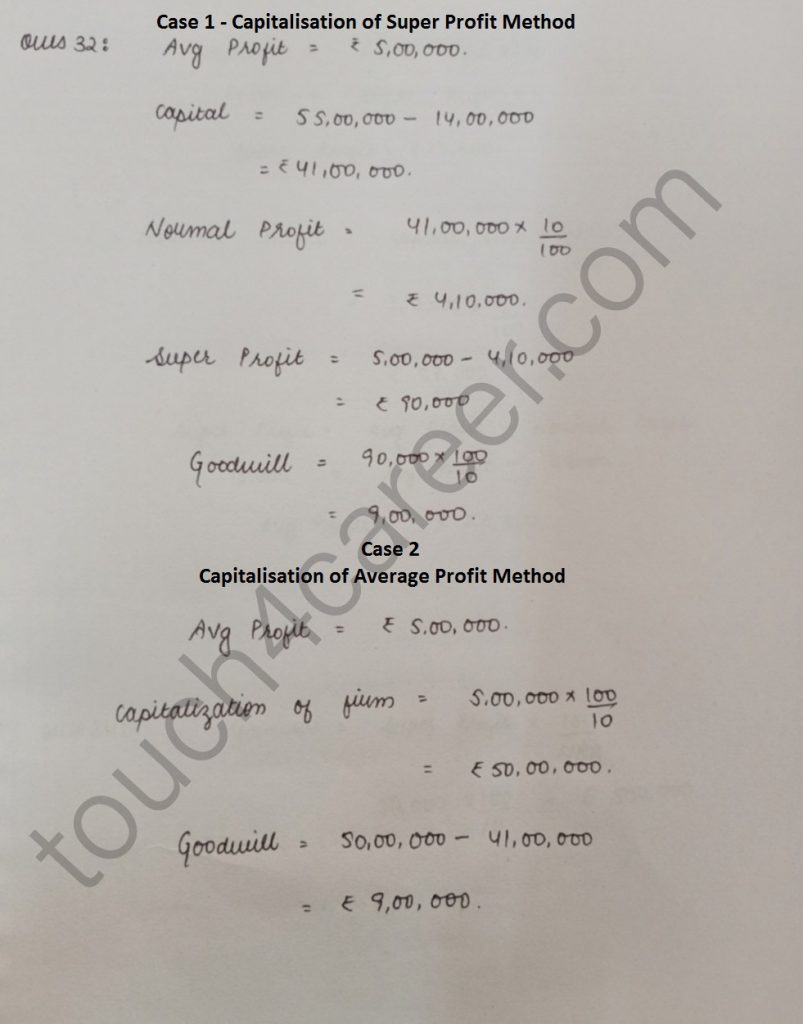

Question 32

A firm earns profits of Rs.5,00,000. Normal rate of return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outsiders liabilities as on the date of goodwill are Rs.55,00,000 and Rs.14,00,000 respectively. Calculate value of goodwill according to capitalisation of super profit method as we as capitalisation of average profit method.

Solution:

Click here for video explanation:- https://youtu.be/cVqRLM39QhQ

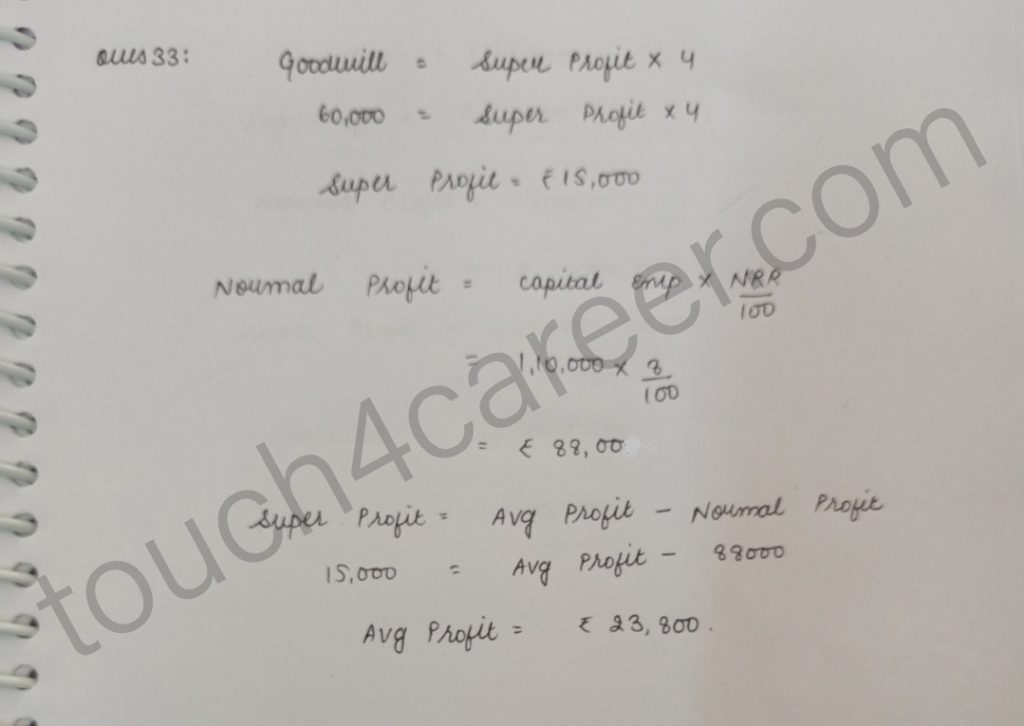

Question 33

On 1st April, 2018 a firm had assets of Rs.1,00,000 excluding stock of Rs.20,000. The current liabilities were Rs.10,000 and the balance constituted partners capital accounts. If the normal rate of return is 8%, the goodwill of the firm is valued of Rs.60,000 at four years purchase of super profit find the actual profits of the firm.

Solution:

Click here for video explanation:- https://youtu.be/cVqRLM39QhQ

Jump to other solutions of Goodwill:

Average Profit Method – Question number 1-6

Average Profit Method when Past Adjustments are Made – Question number 7-12

Weighted Average Profit Method – Question number 13-14

Super Profit method – Question number 15-22

Super Profit Method when Past Adjustments are Made – Question number 23-25

Capitalisation Method – Question number 26-33

Capitalisation of Super Profit – Question number 34-39