Chapter 3 Goodwill:Nature and Valuation-TS Grewal’s 2021

TS Grewal Question 34, 35, 36, 37, 38, 39

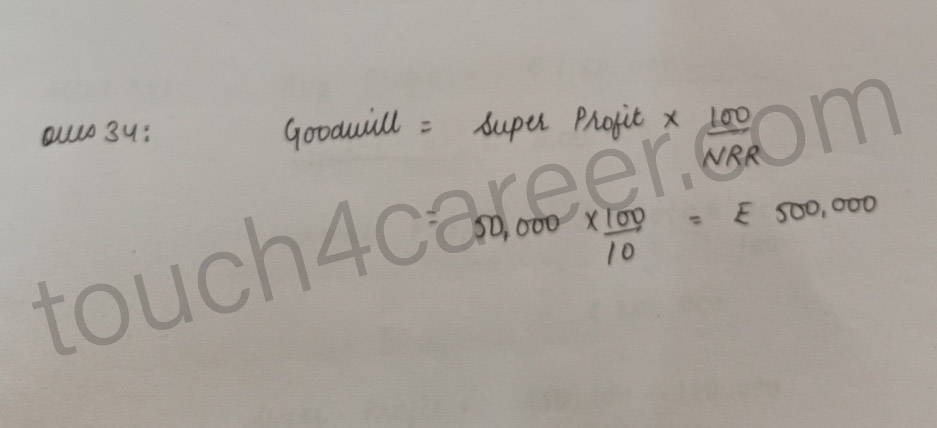

Question 34

Average profit of a firm during the last few years is Rs.1,50,000. In similar business, the normal rate ofretum is 10% of the capital employed. Calculate the value of goodwill by capitalisation of super profit method if super profits of the firm are Rs.50,000

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

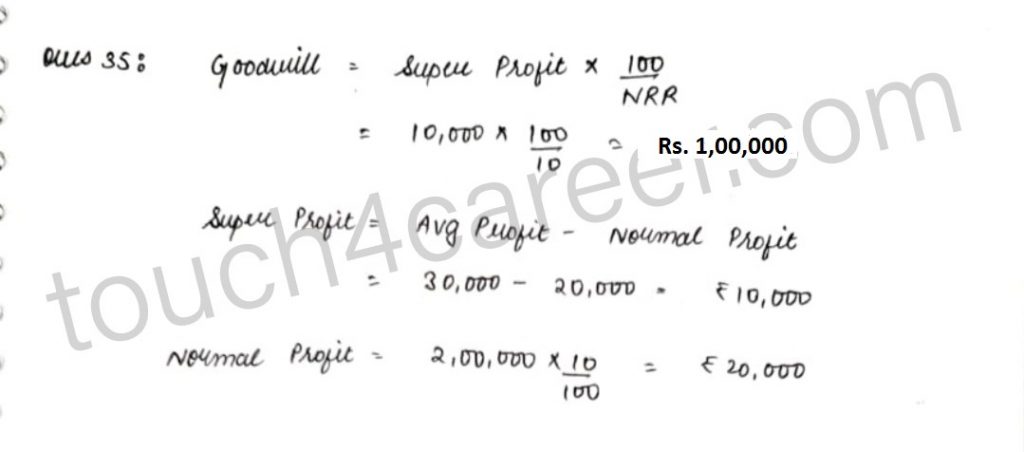

Question 35

Raja Brothers earn an average profit of Rs.30,000 with a capital of Rs.2,00,000.The normal rate of return in the business is 10%. Using capitalisation of super profit method,workout the value of goodwill of the firm.

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

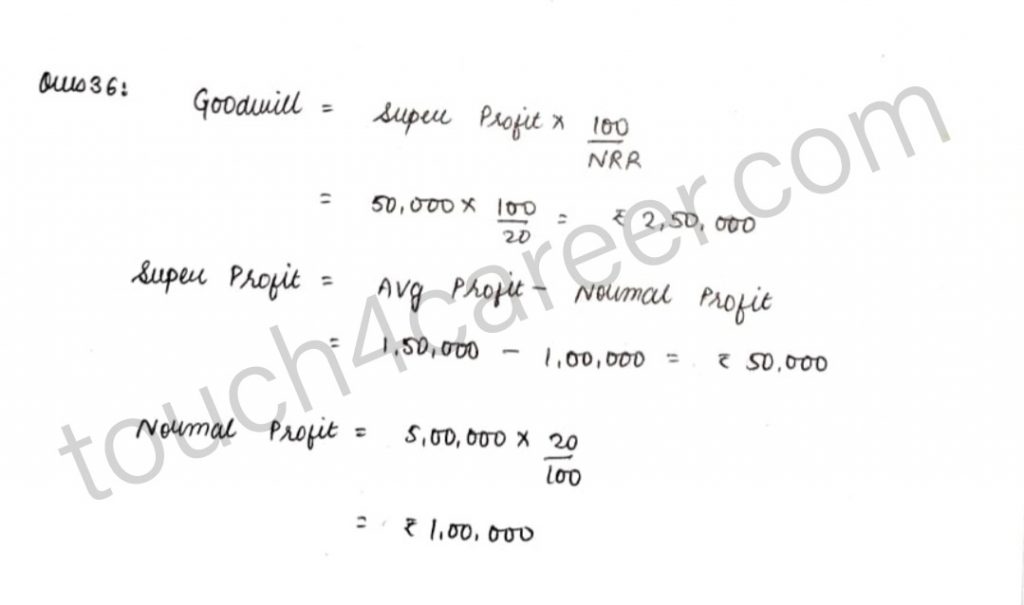

Question 36

Rajan and Rajani are partners in firm. Their capital were Rajan Rs.3,00,00, Rajani Rs.2,00,00. During the year 2017-18, the firm earned a profit of Rs.1,50,000. Calculate the value of goodwill of the firm by capitalisation of super profit assuming that the normal rate of return is 20%.

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

Question 37

Average profit of GS & amp Co. is Rs. 50,000 per year. Average capital employed in the business is Rs. 3,00,000. If the normal rate of return of capital employed is 10%, calculate goodwill of the firm by:

(i) Super Profit Method at three years purchase; and

(ii) Capitalisation of Super Profit Method.

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

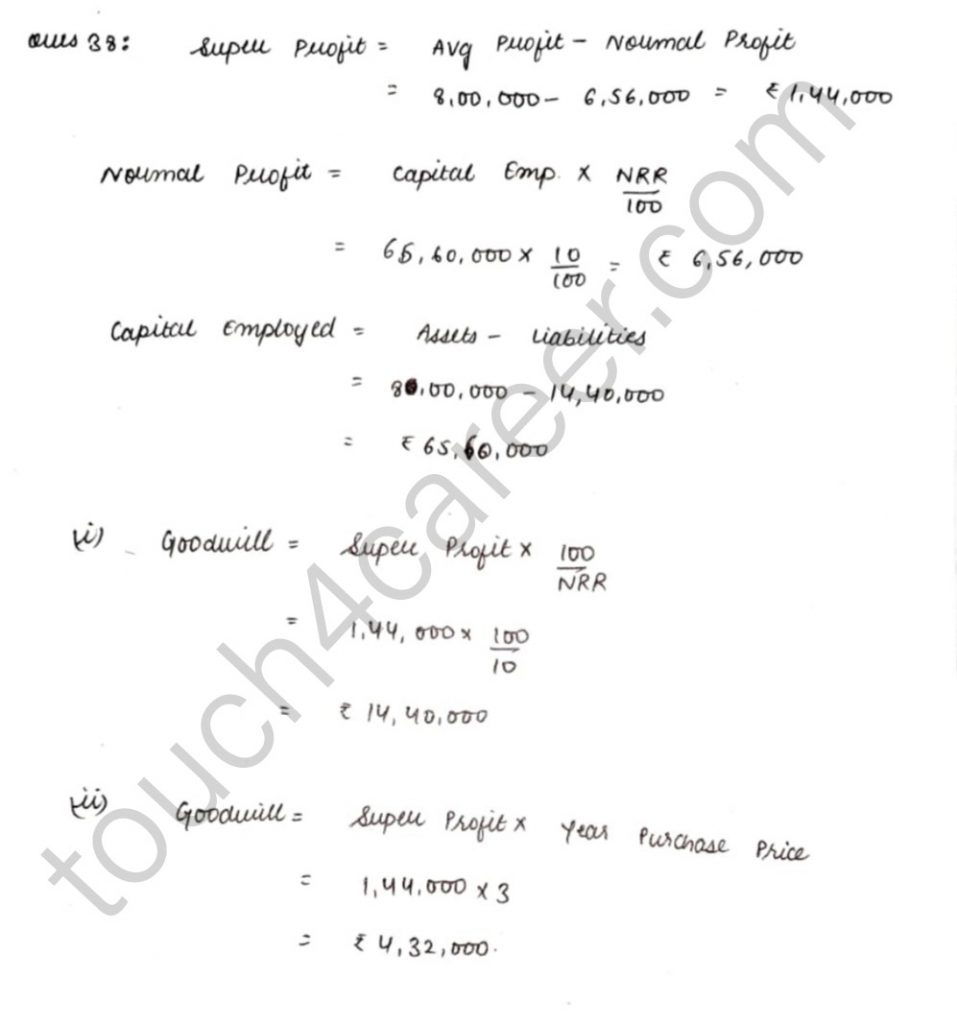

Question 38

A business earned an average profit of Rs. 8,00,000 during the last few years and the normal rate of profit in the similar type of business is 10%.Find the value of Goodwill by:

(i) Capitalisation of Super Profit Method, and

(ii) Super Profit Method if the goodwill is valued at 3 years’ purchase of super profit.

Assets of the business were Rs. 80,00,000 and its external liabilities Rs. 14,40,000.

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

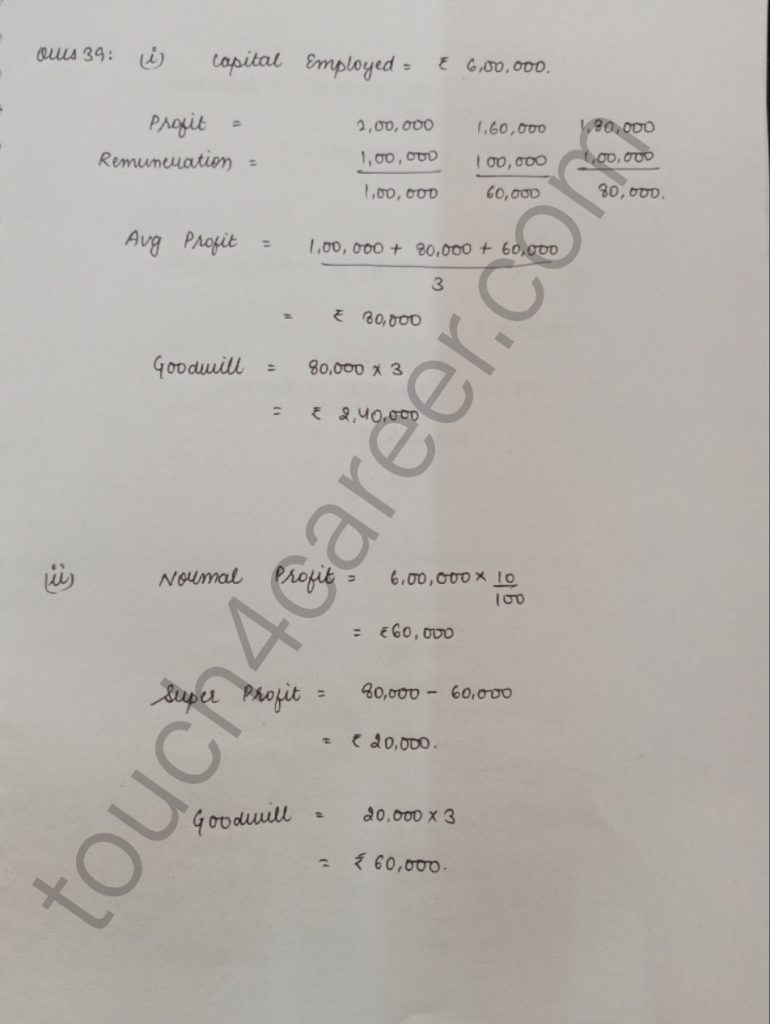

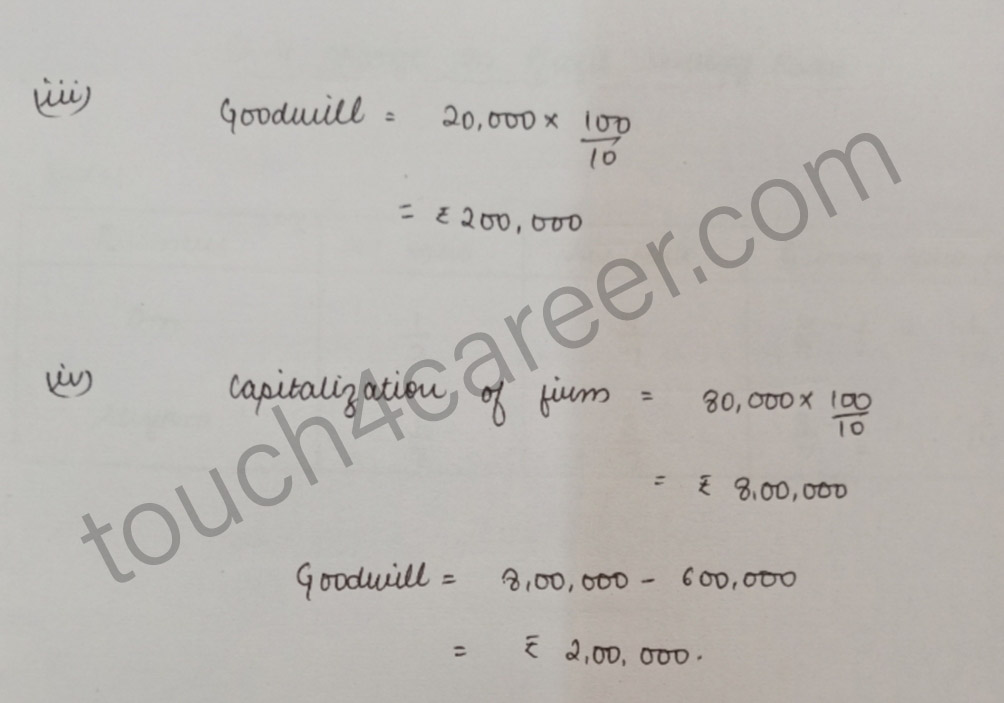

Question 39

From the following information, calculate value of goodwill of the firm:

(i) At three years purchase of Average Profit.

(ii) At three years purchase of Super Profit.

(iii) On the basis of Capitalisation of Super Profit.

(iv) On the basis of Capitalisation of Average profit.

Information:

(a) Average Capital Employed is Rs. 6,00,000.

(b) Net Profit/(Loss) of the firm for the last three years ended are: 31st March, 2108 – Rs.2,00,000, 31st March, 2107 – Rs. 1,80,000, and 31st March, 2106 – Rs. 1,60,000.

(c) Normal Rate of Return in similar business is 10%.

(d) Remuneration of Rs. 1,00,000 to partners is to be taken as charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets and non-trade investments) is Rs.7,00,000 whereas Partners Capital is Rs. 6,00,000 and Outside Liabilities Rs. 1,00,000.

Solution:

Click here for video explanation:- https://youtu.be/DGs__ykQHJY

Jump to other solutions of Goodwill:

Average Profit Method – Question number 1-6

Average Profit Method when Past Adjustments are Made – Question number 7-12

Weighted Average Profit Method – Question number 13-14

Super Profit method – Question number 15-22

Super Profit Method when Past Adjustments are Made – Question number 23-25

Capitalisation Method – Question number 26-33

Capitalisation of Super Profit – Question number 34-39