Chapter 3 Goodwill:Nature and Valuation-TS Grewal’s 2021

TS Grewal Question 15, 16, 17, 18, 19, 20, 21, 22

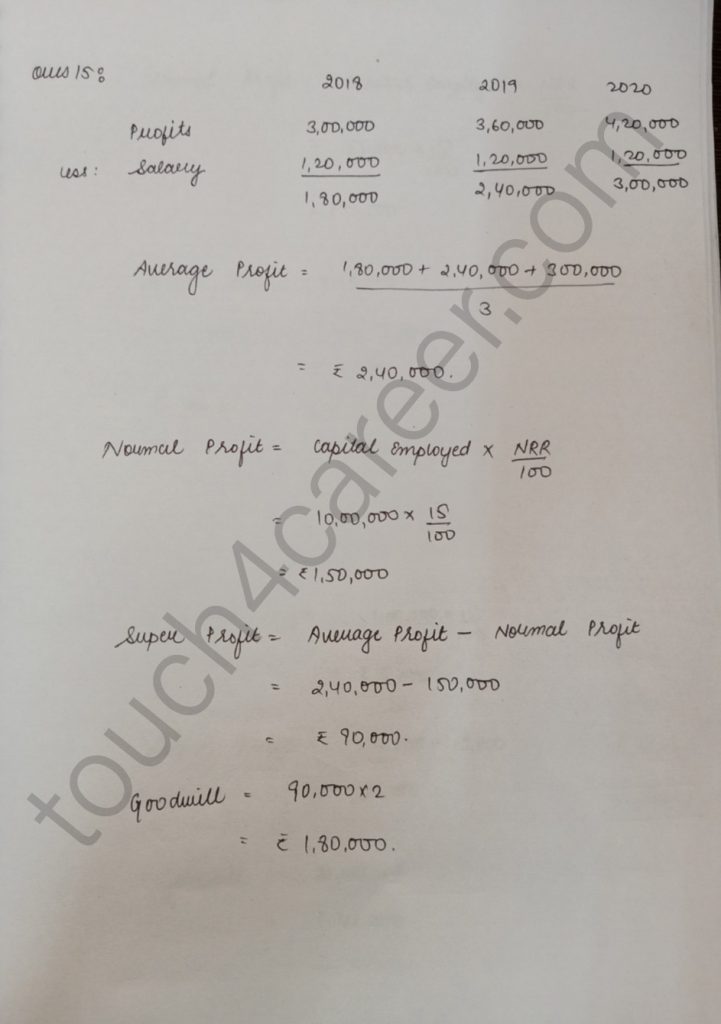

Question 15

The capital of the firm of Anuj and Benu is Rs.10,00,000 and market rate of interest is 15%. Annual salary to the partners is Rs.60,000 each. The profit for the last three years were Rs.3,00,000, Rs.3,60,000 and Rs.4,20,000. Goodwill of the firm is to be valued on the basis of two years purchase of last three years average super profit. Calculate Goodwill.

Solution:

The capital of the firm of Anuj and Benu

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

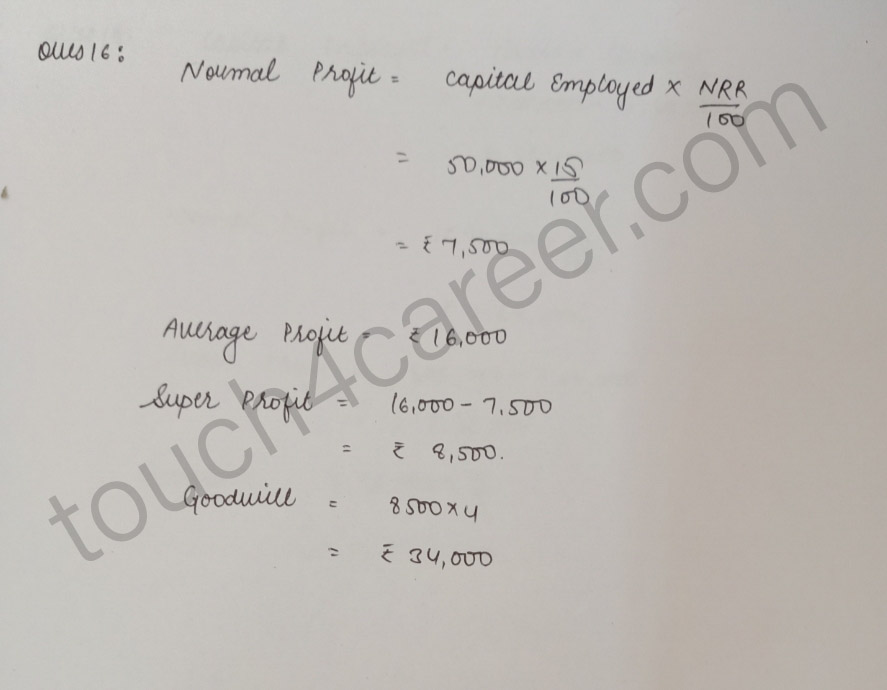

Question 16

Gupta and Bose had a firm in which they had invested Rs.50,000. On an average, the profits were Rs.16,000. The normal rate of return in the industry is 15%. Goodwill is to be valued at four years purchase of profits in excess of profits @15% on the money invested. Calculate goodwill.

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

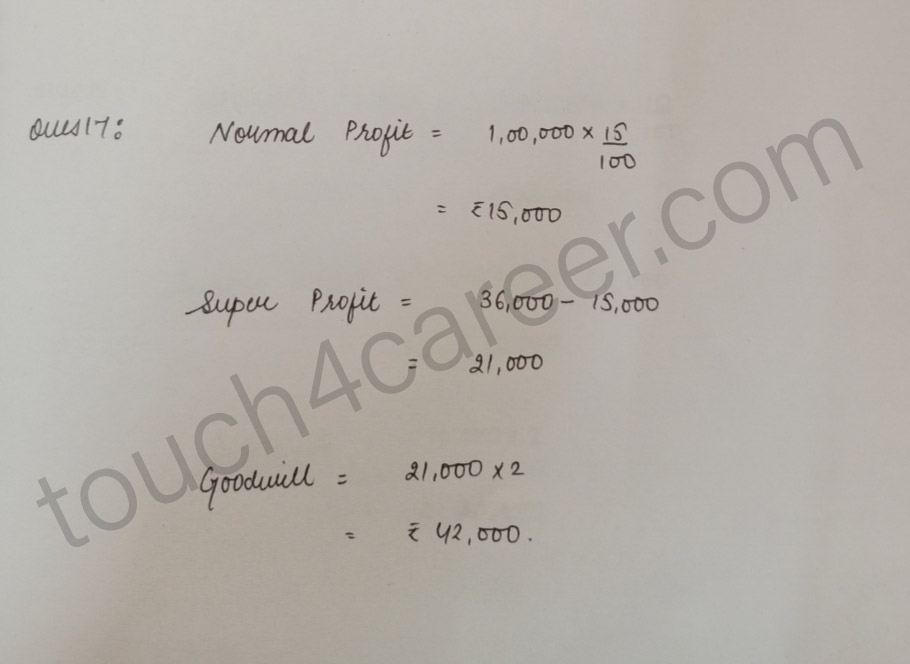

Question 17

Total capital of the firm of Sakshi Mehak and Megha is Rs.1,00,000 and the market rate of interest is 15%. The net profits for the last 3 years were Rs.30,000, Rs.36,000 and Rs.42,000. Goodwill is to be valued at 2 years purchase of the last 3 years super profit.

Calculate the goodwill of the firm.

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

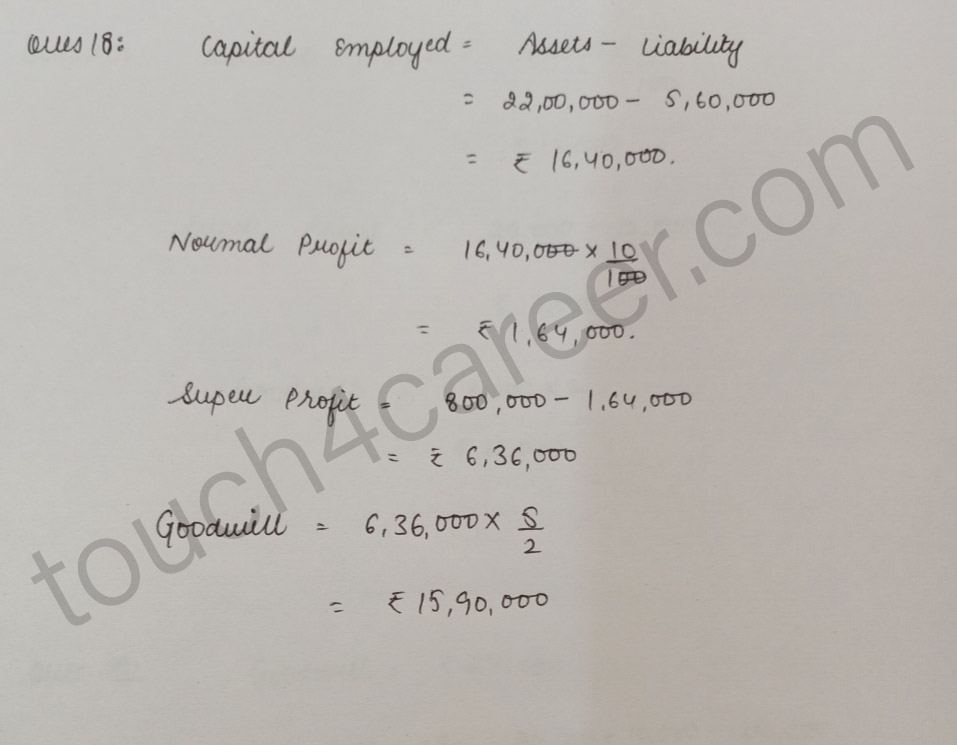

Question 18

A business earned an average profit of Rs.8,00,000 during the last few years. The normal rate of profit in the similar type of business is 10%. The total value of assets and liabilities of the business were Rs.22,00,000 and Rs.5,60,000 respectively. Calculate goodwill of the firm by super profit method if it is valued at 2.5 years purchase of super profit.

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

Question 19

Average net profit expected in future by XYZ firm is Rs.36,000 per year. Average capital employed in the business by the firm is Rs.2,00,000. The normal rate of return from capital invested in this class of business is 10%. Remuneration of the partners is estimated to be Rs.6,000 p.a. Calculate the value of goodwill on the basis of two years purchase of super profit.

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

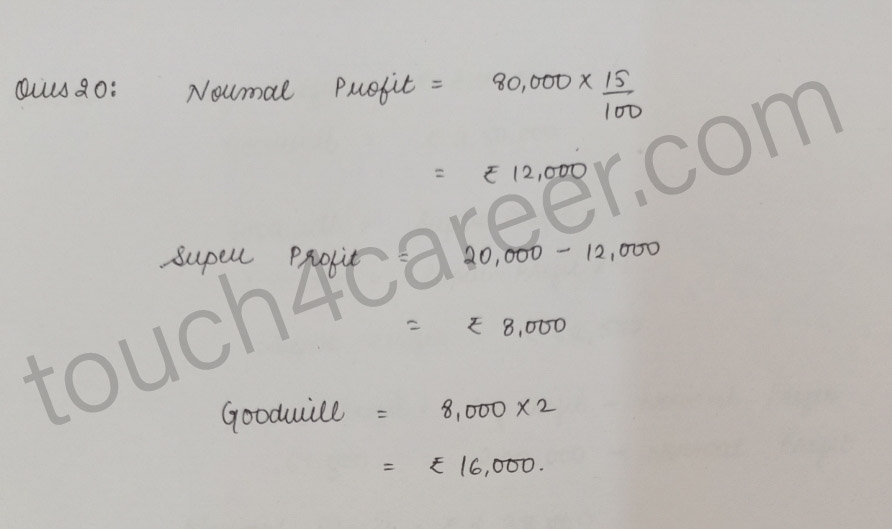

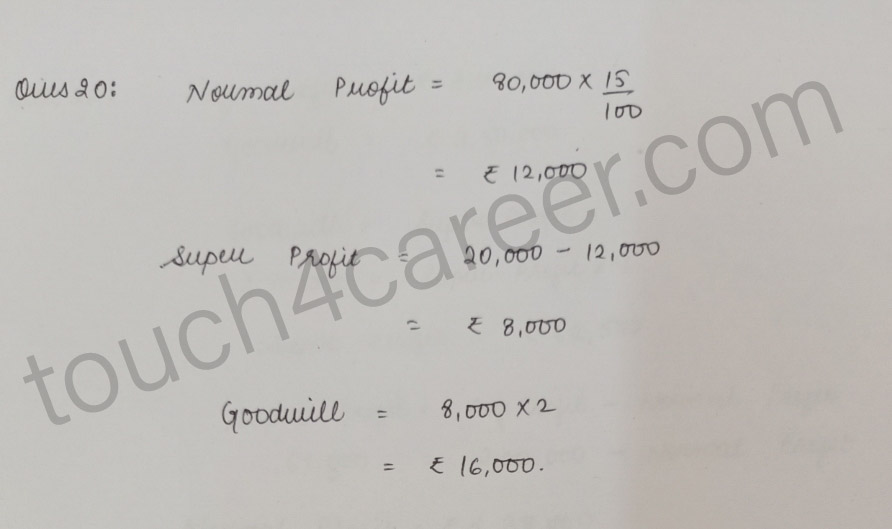

Question 20

A partnership firm earned net profits during the last three years ended 31st March as follows:

2019 – Rs.17,000; 2020 – Rs.20,000; 2021 – Rs.23,000

Capital investment in the firm throughout the above mentioned period has been Rs.80,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. Calculate value of goodwill on the basis of two years purchase of average super profit earned during the above mentioned three years.

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

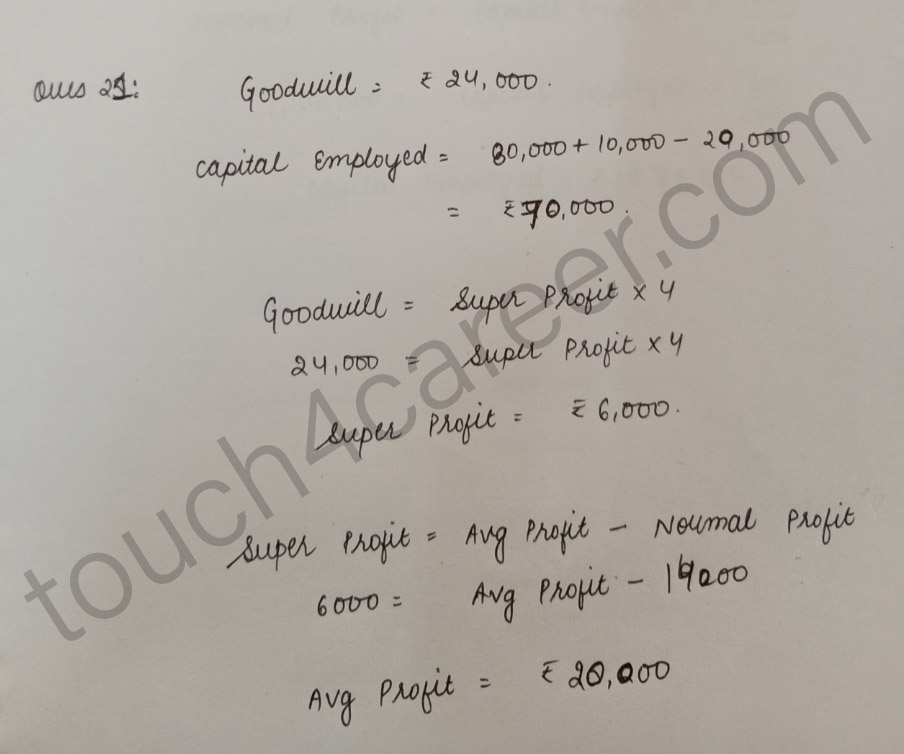

Question 21

On 1st April, 2021, an existing firm had assets of Rs. 75,000 including cash of Rs.5,000. Its creditors amounted to Rs. 5,000 on that date. The firm had a Reserve of Rs. 10,000 while Partners Capital Accounts showed a balance of Rs. 60,000. If Normal Rate of Return is 20% and goodwill of the firm is valued at Rs. 24,000 at four years purchase of super profit, find average profit per year of the existing firm.

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

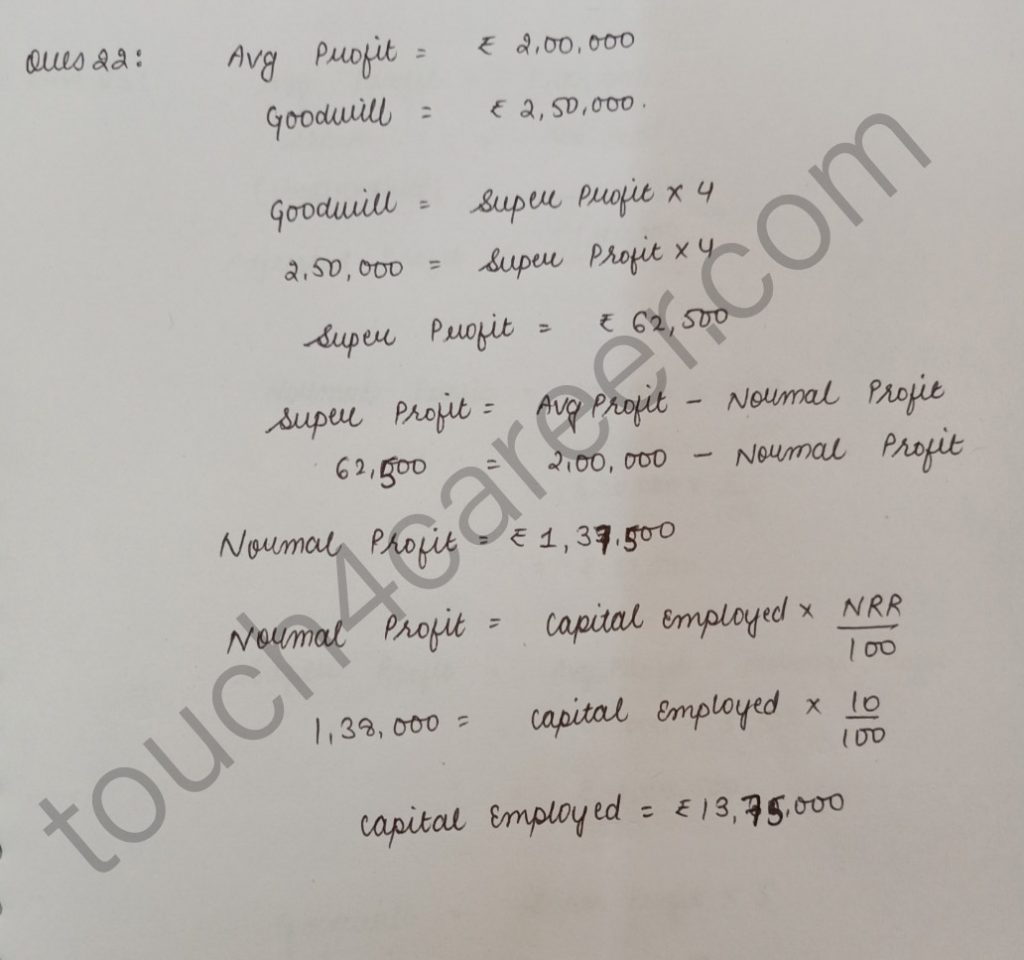

Question 22

Average profit of a firm during the last few years is Rs.2,00,000 and the normal rate of return in a similar business is Rs.2,50,000 at 4 years purchase of super profit, Find the capital employed by the firm

Solution:

Click here for video explanation:- https://youtu.be/mbdFpA0BJ5w

Jump to other solutions of Goodwill:

Average Profit Method – Question number 1-6

Average Profit Method when Past Adjustments are Made – Question number 7-12

Weighted Average Profit Method – Question number 13-14

Super Profit method – Question number 15-22

Super Profit Method when Past Adjustments are Made – Question number 23-25

Capitalisation Method – Question number 26-33

Capitalisation of Super Profit – Question number 34-39