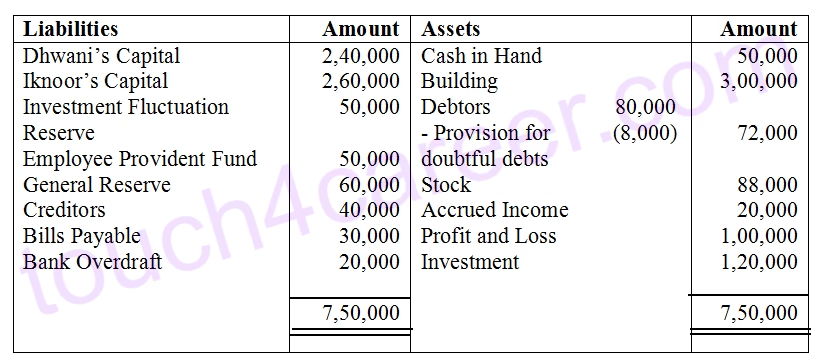

25. Dhwani and Iknoor were partners sharing Profits & Losses in the ratio 3:2. Their Balance Sheet on March 31, 2025 was as follows

On the above date, they admitted Ishaya into partnership for 25% share. Ishaya brings Rs 2,50,000 as capital and Rs 40,000 for goodwill. Goodwill of the firm was valued at Rs 2,00,000. Following agreements were agreed upon:-

a) Bad Debts amounted to Rs 5,000 and Provision for doubtful debts to be created at same existing rate.

b) Investments were valued at Rs 1,00,000.

c) Accrued Income was recovered only of Rs 14,500 in settlement.

d) Building was overvalued by 20%.

e) Capital of Dhwani and Iknoor were to be adjusted on the basis Ishaya’s capital contribution. Necessary adjustment to be done by opening Current Accounts.

You are required to prepare Revaluation Account and Partner’s Capital Account at the time of admission of partner.

Solution :-

WORKING NOTES :

Calculation of New Profit Sharing Ratio

Dhwani = 3/4 x 3/5 = 9/20

Iknoor = 3/4 x 2/5 = 6/20

Ishaya = 1/4 x 5/5 = 5/20

Calculation of Gaining and Sacrificing ratio of partners

New Ratio – Old Ratio

Dhwani = 9/20 – 3/5 = -3/20 (Sacrifice)

Iknoor = 6/20 – 2/5 = -2/20 (Sacrifice)

Ishaya = 5/20 (Gain)

Sacrificing ratio of Dhwani and Iknoor is 3:2

Calculation of share of Goodwill

Dhwani’s share of goodwill = 40,000 x 3/5 = Rs 24,000

Iknoor’s share of goodwill = 40,000 x 2/5 = Rs 16,000

Adjustment of Capital

Ishaya’s Capital = Rs 2,50,000

Ishaya’s share in Profit = 1/4

Total Capital of the firm = 2,50,000 x 4 = Rs 10,00,000

Dhwani’s New Capital = 10,00,000 x 9/20 = Rs 4,50,000

Iknoor’s New Capital = 10,00,000 x 6/20 = Rs 3,00,000