19 :- C, D and E were partners in a firm sharing profits in the ratio of 3:1:1. Their balance sheet as at 31st March 2022 was as follows :

On the above date, the firm was dissolved due to certain disagreements among the partners :

(i) Machinery of Rs 3,00,000 were given to creditors in full settlement of their account and remaining machinery was sold for Rs 10,000.

(ii) Investment realised Rs 2,90,000.

(iii) Stock was sold for Rs 1,80,000.

(iv) Debtors for Rs 20,000 proved bad.

(v) Realisation expenses amounted to Rs 10,000.

Prepare realisation account.

20 :- Ramesh and Umesh were partners in a firm sharing profits in the ratio of their capitals. On 31st March 2025, their balance sheet was as follows :

On the above date the firm was dissolved.

(a) Ramesh took 50% of stock at Rs 10,000 less than book value.

(b) Furniture was taken by Umesh for Rs 50,000 and machinery was sold for Rs 4,50,000.

(c) Creditors were paid in full.

(d) There was an unrecorded bill for repairs forRs 1,60,000 which was settled and paid at Rs 1,40,000.

Prepare realisation account.

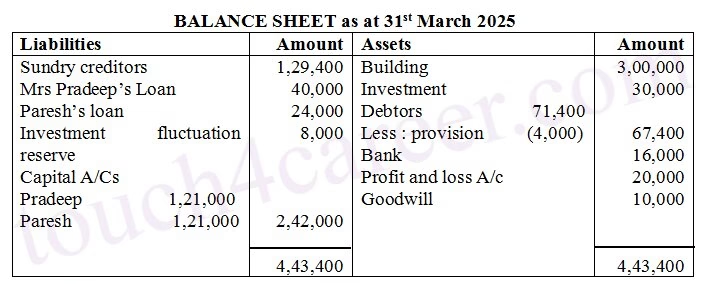

21 :- Pradeep and Paresh partners in a firm decided to dissolve their partnership firm on 1st April 2025. Pradeep was deputed to realise the assets and to pay off the liabilities. He was paid Rs 10,000 as commission for his services. Balance sheet of the firm on 31st March 2025 was as follows

Following terms and conditions were agreed upon :

(a) Pradeep agreed to pay his wife”s loan.

(b) Investment was given to Paresh for Rs 27,000.

(c) Building realised Rs 3,50,000.

(d) Creditors were to be paid ater two months, they were paid immediately at 10% p.a. discount.

(e) Realisation expenses were Rs 2,500.

Prepare Realisation Account.

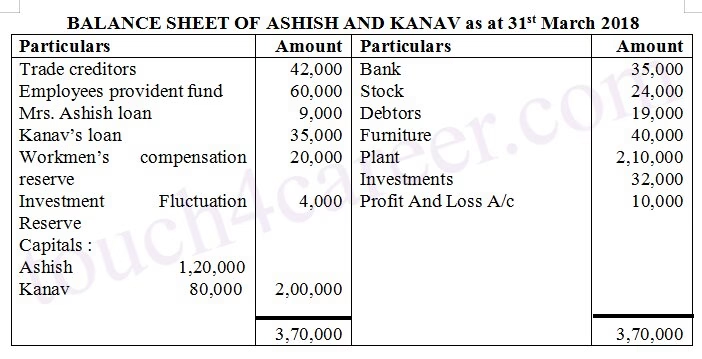

22 :- Ashish and Kanav were partners in a firm sharing profits and losses in the ratio of 3:2. On 31st March 2018 their Balance Sheet was as follows :

On the above date they decided to Dissolve the firm.

(a) Ashish agreed to take over furniture at Rs 38,000 and pay Mrs. Ashish’s loan.

(b) Debtors realised Rs 18,500 and plant realised 10% more.

(c) Kanav took over 40% of the stock at 20% less than the book value. Remaining stock was sold at a gain of 10%.

(d) Trade creditors took over investments in full settlement.

(e) Kanav agreed to take over the responsibility of completing dissolution at an agreed remuneration of Rs 12,000 and to bear realisation expenses. Actual expenses of realisation amounted to Rs 8,000.

Prepare Realisation Account.