10 :- A and B are partners in a firm sharing profits in the ratio of 2 : 1. They decided that with effect from 1st April 2024, they would share profits in the ratio of 3 : 2. But, this decision was taken after the profit for the year ended 31st March 2025 of Rs 90,000 was distributed in the old profit sharing ratio.

Firm’s goodwill was valued on the basis of aggregate of two year’s profits preceding the date decision became effective.

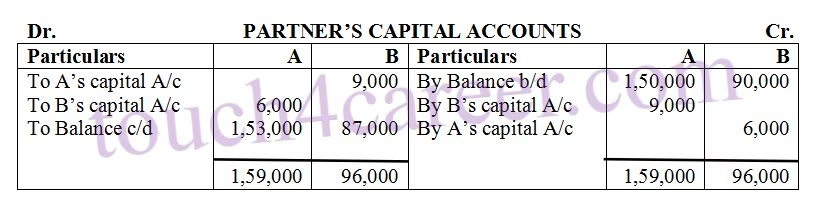

Profits for the years ended 31st March 2023 and 2024 were Rs 60,000 and Rs 75,000 respectively. Capital Accounts of the partners as at 31st March 2025 stood at Rs 1,50,000 for A and Rs 90,000 for B.

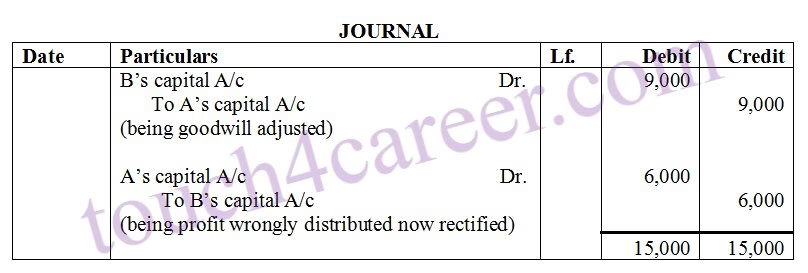

Pass necessary journal entries and prepare partner’s capital accounts.

Solution:-

WORKING NOTES :-

- Calculation of gain/sacrifice of partners

Old ratio = 2:1

New ratio = 3:2

Calculation of Partner’s Sacrifice/gain

A = 2/3 – 3/5 = 10 – 9/15 = 1/15 (sacrifice)

B = 1/3 – 2/5 = 5 – 6/15 = -1/15 (gain)

- Calculation of goodwill of the firm

Goodwill of the firm = 60,000 + 75,000

= Rs 1,35,000

Calculation of partner’s share in goodwill

A’s share in goodwill = 1,35,000 x 1/15 = Rs 9,000 (credit)

B’s share in goodwill = 1,35,000 x 1/15 = Rs 9,000 (debit)

Calculation to adjust wrong distribution of profits

A’s share in profits = 9,000 x 1/15 = Rs 6,000 (debit)

B’s share in profits = 9,000 x 1/15 = Rs 6,000 (credit)