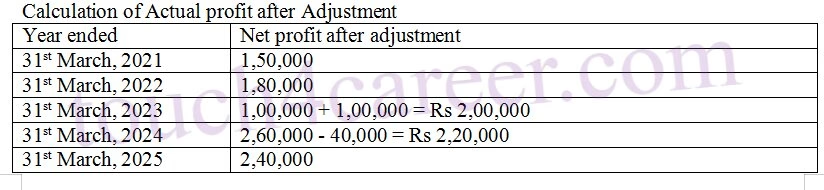

24 :- Akshay and Amit are partners in a firm and they admit Jaspal into partnership w.ef. 1st April, 2025. They agreed to value goodwill at 3 years purchase of Super Profit Method for which they decided to average profit of last 5 years. The profits for the last 5 years were :

The firm has total assets of Rs 20,00,000 and outside Liabilties of Rs 5,00,000 as on that date. Normal rate of return in similar business is 10%.

Calculate value of goodwill.

Solution :-

Average profit of last 5 years = 1,50,000 + 1,80,000 + 2,00,000 + 2,20,000 + 2,40,000/5

= 9,90,000/5

= Rs 1,98,000

Calculation of capital employed

Capital Employed = Total assets – Outside liabilties

= 20,00,000 – 5,00,000

= Rs 15,00,000

Calculation of the normal profit of the firm

Normal profit = Capital employed x Normal rate of return

= 15,00,000 x 10%

= Rs 1,50,000

Calculation of Super profit of the firm

Super Profit = Average profit – Normal profit

= 1,98,000 – 1,50,000

= Rs 48,000

Calculation of goodwill of the firm

Goodwill = Super profit x No. Of years purchased

= 48,000 x 3

= Rs 1,44,000