74 :- On 31st March 2014, the balances in the capital accounts of Saroj, Mahinder, and Umar after making adjustments for profits and drawings, etc., were Rs 80,000, Rs 60,000, and Rs 40,000 respectively. Subsequently, it was discovered that the interest on capital and drawings has been omitted.

a) The profit for the year ended 31st March 2014 was Rs 80,000.

b) During the year Saroj and Mahiner each withdrew a sum of Rs 24,000 in equal installments at the end of each month and Umar withdrew Rs 36,000.

c) The interest on drawings was to be charged @ 5% p.a. and interest on capital was to be allowed @ 10% p.a.

d) The profit-sharing ratio among partners was 4 :3 : 1.

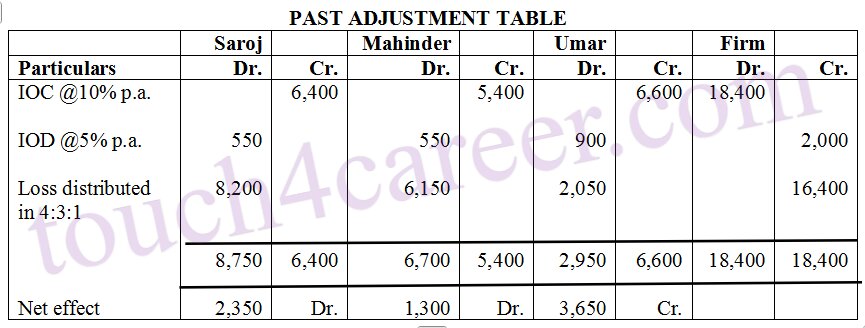

Showing your workings clearly, pass the necessary rectifying entry.

Solution:-

WORKING NOTES :-

(A) Calculation of interest on Saroj’s capital

Opening capital of Saroj = Closing capital + Drawings – Profit

= 80,000 + 24,000 – 40,000

= Rs 64,000

Interest on Saroj’s capital = 64,000 x 10/100 = Rs 6,400

(B) Calculation of interest on Mahinder’s capital

Opening capital of Mahinder = Closing capital + drawings – profit

= 60,000 + 24,000 – 30,000

= Rs 54,000

Interest on Saroj’s capital = 54,000 x 10/100 = Rs 5,400

(C) Calculation of interest on Umar’s capital

Opening capital of Umar = Closing capital + Drawings – Profit

= 40,000 + 36,000 – 10,000

= Rs 66,000

Interest on Umar’s capital = 66,000 x 10/100 = Rs 6,600