9 :- Raman and Daman are partners sharing profits in the ratio of 60 : 40 and for the last four years they have been getting annual salaries of Rs 50,000 and Rs 40,000 respectively. The annual accounts have shown the following net profit before charging partner’s salaries:

Year ended 31st March, 2023 – Rs 1,40,000; 2024 – Rs 1,01,000 and 2025 – Rs 1,30,000.

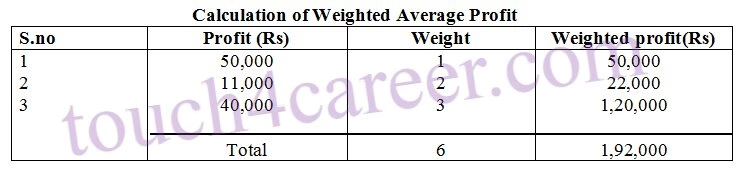

On 1st April, 2025, Zeenu is admitted to the partnership for 1/4th share in profit (without any salary). The Goodwill is to be valued at four years’ purchase of weighted average profit of the last three years (after partner’s salaries); Profits are to be weighted as 1, 2, and 3, the greatest weight being given to the last year. Calculate the value of Goodwill.

Solution:- Calculation of normal profit after adjustments

Actual normal profit after partner’s salaries

2023 = 1,40,000 – (50,000 + 40,000) = Rs 50,000

2024 = 1,01,000 – (50,000 + 40,000) = Rs 11,000

2025 = 1,30,000 – (50,000 + 40,000) = Rs 40,000

Weighted average profit = Total weighted profits/Total weights

Weighted average profits = 1,92,000/6

= Rs 32,000

Calculation of goodwill of the firm

Goodwill = Weighted Average Profit x No. of years purchased

= 32,000 x 4

= Rs 1,28,000