17 :- Atul and Mithun are partners sharing profits in the ratio of 3 : 2. Balances as on 1st April 2024 were as follows:

Capital accounts (fixed): Atul – Rs 5,00,000 and Mithun – Rs 6,00,000

Loan accounts : Atul – Rs 3,00,000(Cr) and Mithun – Rs 2,00,000 (Dr)

It was agreed to allow and charge interest @8% p.a. Partnership deed provided to allow interest on capital @10% p.a. interest on drawings was charged Rs 5,000 each.

Profit before giving effect to above was Rs 2,28,000 for the year ended 31st March 2025.

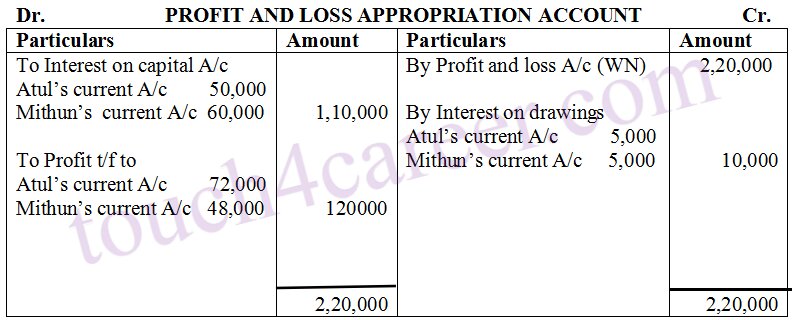

Prepare profit and loss appropriation Account.

Solution :-

WORKING NOTES :

Calculation of net profit (in Rs)

Gross profit 2,28,000

Add: interest on loan to Mithun 16,000

Less: interest on loan from Atul 24,000

Net profit 2,20,000